What Is a Series LLC?

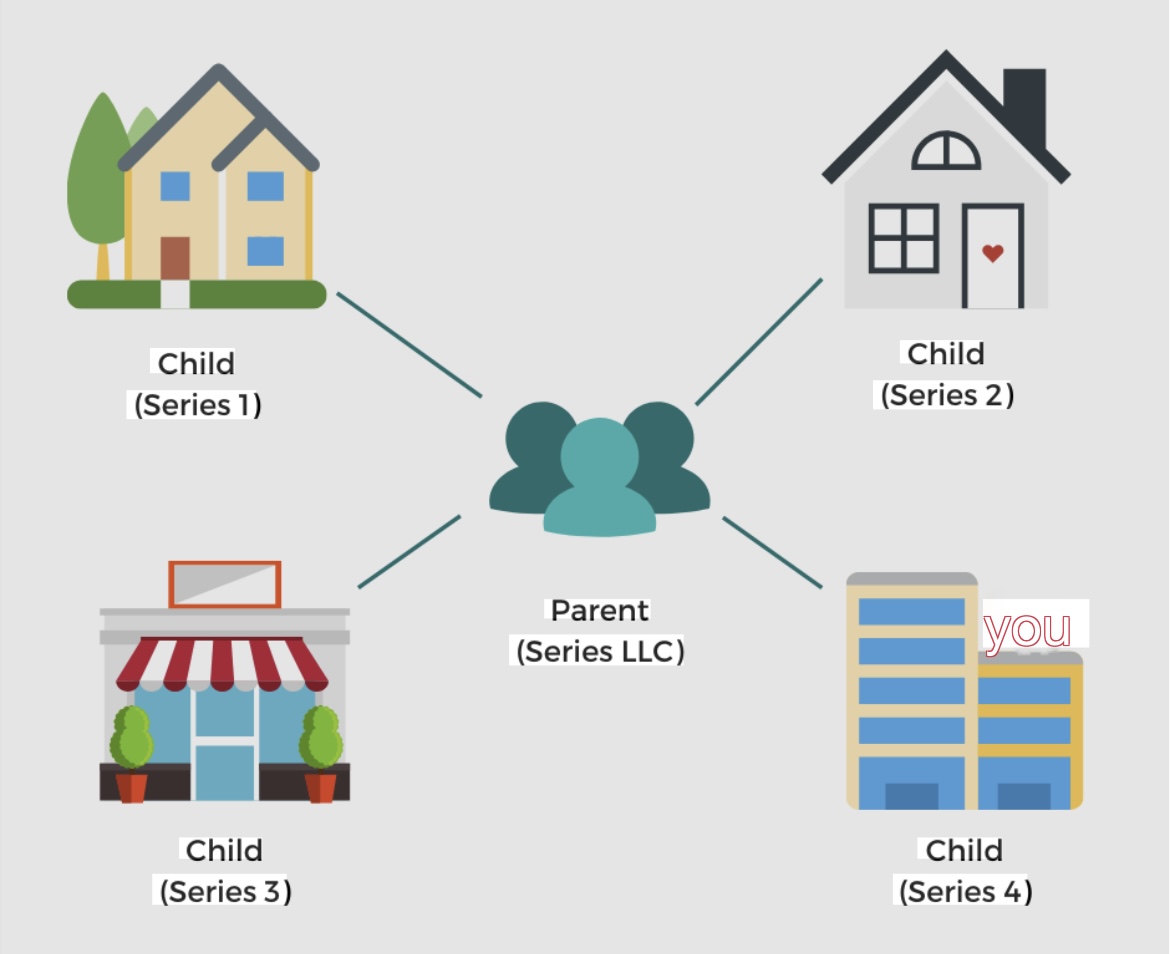

A Series LLC is a special type of limited liability company that allows one parent LLC to create multiple legally distinct series (or “cells”) under a single structure.

Each series can:

- Own its own assets

- Run a separate business

- Enter into contracts

- Have its own liabilities

At the same time, the Series LLC allows you to centralize administration, payroll, and management instead of duplicating everything across multiple standalone LLCs.

For business owners operating in states that recognize Series LLCs, this structure can be a game-changer.

Why Business Owners Use Series LLCs

Most entrepreneurs don’t start with a complicated structure. They add LLCs as they grow.

Eventually, that leads to:

- Too many entities

- Too many filings

- Too many bank accounts

- Too many compliance deadlines

- Higher costs and higher risk of mistakes

A Series LLC solves this problem by allowing you to separate risk without multiplying paperwork.

Centralized Administration (Fewer Filings, Less Overhead)

One of the biggest advantages of a Series LLC is administrative efficiency.

Instead of managing multiple standalone LLCs, a Series LLC often allows:

- One parent filing with the state

- One registered agent

- One core operating agreement (with series add-ons)

- Centralized compliance tracking

This reduces:

- Annual filing costs

- Missed deadlines

- Administrative fatigue

- Risk of losing liability protection due to oversight

Centralized Payroll and HR

Payroll is one of the most common areas where businesses create unnecessary risk.

With multiple LLCs, payroll often becomes:

- Fragmented

- Inconsistent

- Difficult to audit

- Prone to wage and hour errors

A properly structured Series LLC can allow:

- Payroll to be handled centrally

- Employees to be allocated or leased to individual series

- Consistent HR policies

- Cleaner workers’ compensation coverage

This creates better compliance and lowers operational stress.

Liability Protection Without Cross-Contamination

Each business activity carries risk. When everything is inside one traditional LLC, one lawsuit can put all assets at risk.

A Series LLC helps prevent that by:

- Isolating liabilities within each series

- Preventing claims against one series from reaching another

- Allowing high-risk and low-risk activities to remain separate

This is especially valuable for:

- Real estate investors

- Construction companies

- Developers

- Multi-location businesses

- Asset-heavy operations

Preventing Cross-Contamination Between Series

Series LLC protection works best when the structure is respected.

That means:

- Separate bank accounts per series

- Contracts signed in the correct series name

- Proper asset titling

- Clean accounting

- Documented inter-series transactions

When done correctly, this creates clear legal boundaries that are far more defensible.

Personal Liability Protection for Owners

One of the main goals of business structuring is to reduce personal exposure.

A Series LLC supports this by:

- Placing operational risk at the series level

- Keeping owners removed from daily liability

- Allowing centralized control without direct exposure

While no structure eliminates risk entirely, Series LLCs can significantly strengthen personal asset protection when properly maintained.

Centralized Management and Intellectual Property

Many businesses need:

- One brand

- One management team

- One system of operations

A Series LLC can support:

- Centralized management at the parent level

- Licensing of intellectual property to individual series

- Internal management or licensing fees

- Consistency across multiple businesses

This structure improves efficiency and makes scaling easier.

Built for Growth and Expansion

Series LLCs are ideal for businesses that:

- Launch new projects frequently

- Acquire assets regularly

- Open new locations

- Test new business ideas

Instead of forming a new LLC each time, you can:

- Create a new internal series

- Assign assets and operations

- Maintain centralized oversight

This allows you to grow without constantly rebuilding your legal structure.

Reduced State Filings and Ongoing Costs

In many Series-LLC-friendly states:

- Only the parent LLC files annually

- Series may not require separate filings

- Registered agent costs are reduced

- Compliance is streamlined

Over time, this can save thousands of dollars and countless administrative hours.

Who Should Consider a Series LLC?

Series LLCs are especially effective for:

- Real estate investors with multiple properties

- Construction and development companies

- Businesses with multiple brands or locations

- Equipment-heavy operations

- Entrepreneurs running multiple ventures

If you operate more than one business—or plan to—you should strongly consider whether a Series LLC fits your goals.

Important Considerations Before Using a Series LLC

Series LLCs are powerful, but they are not plug-and-play.

They require:

- Formation in a state that recognizes Series LLCs

- Proper operating agreements

- Disciplined accounting

- Ongoing compliance

Poor setup or sloppy operation can undermine the benefits. Professional guidance is strongly recommended.

Final Takeaway

A Series LLC can:

- Centralize administration and payroll

- Isolate liability between businesses

- Reduce state filings and costs

- Protect personal assets

- Create a scalable foundation for growth

If you live in a state that recognizes Series LLCs and operate multiple businesses, this structure deserves serious consideration.

Leave a Reply